Alright, first thing you need to know about the CPA exam is that it is expensive. To get scheduled for the exam, you need to pay both an application fee and an examination fee with you first application. The fees break down as follows:

Application fee (non-refundable): $147.00

Examination Fee:

Auditing and Attestation(AUD) $195.35

Business Environment and Concepts(BEC) $176.25

Financial Accounting and Reporting(FAR) $195.35

Regulation(REG) $176.25

You can apply for more than one section at a time, but your application window is only open for six months. When that application window closes, you have to re-apply and send in another application fee (though slightly less than the first application fee).

Usually within two weeks or so, you will get a response back. If found eligible, they will send you a Notice to Schedule, which has the information needed to schedule your testing dates with the testing center.

Anyways, the first time around, I signed up for three sections (FAR,REG, and AUD). I was trying to keep the fees to a minimum by signing up for the most exams that I thought I could pass with in six months. I ended up paying $713.95. The second time, I only had to sign up for BEC, which cost $234.25. So in total, I spent $948.20 on the actual exam.

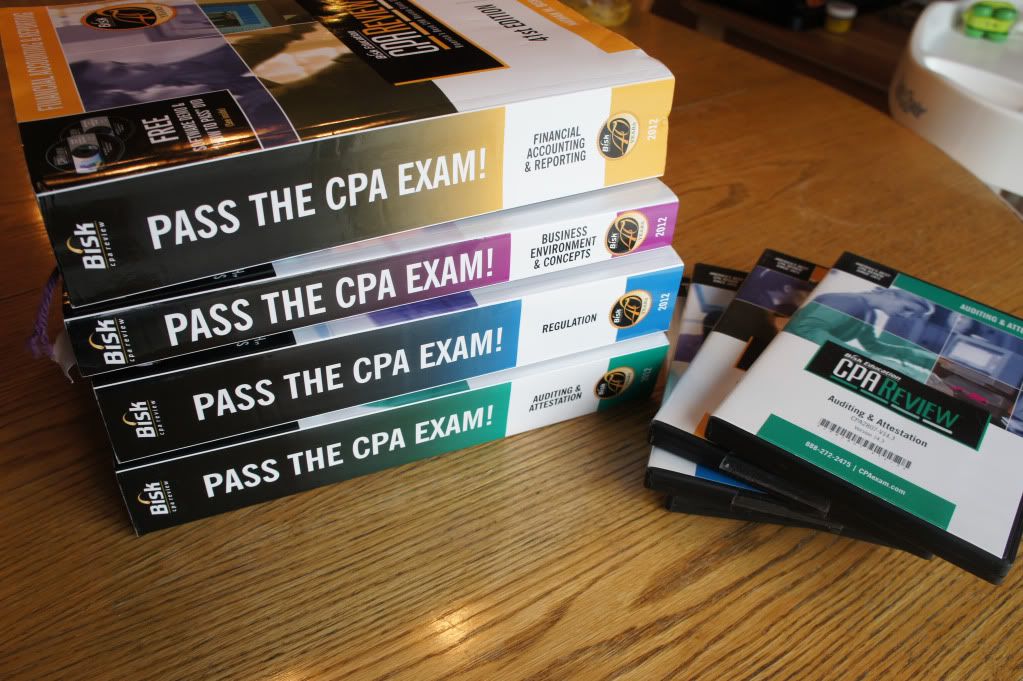

But that isn't the only cost related to the exam. In order to pass, you need to purchase study materials. Now there are a lot of options out their in terms of CPA review material (self-study, classes, books, software, audio CD's, DVD's). There are some more well known materials, such as Becker and Gleim, but these tend to be more expensive (up to $3,000). I had discussed with some of my co-workers at the time what they had used. Most of them had used the BISK CPA review material and had success. BISK is more on the affordable side. For text books and review software for all four sections, I paid $702.45.

So in total, the CPA exam and review materials ended up costing me $1,650.65. Like I said, depending on what review software you use and how many application fees you end up paying, it could cost you much more.

Ok, the second thing you need to know is that studying for the CPA exam is very time consuming. Inevitably, there are people who think they can just study a little bit and be fine. They typically end up contributing to the low passing rates that the CPA exam is known for.

First thing I did was start by reading through all four books. This in itself was time consuming. At this point, I hadn't signed up for any particular exam. I was only trying to get a feel for the topics, the sections, and which I thought I would need to spend the most time on.

After reading through the books, I determined that I first wanted to take FAR. Based on what other people had said and based on the number and variety of topics covered, I knew this would be one of the more difficult sections, and I wanted to get it out of the way first.

My study pattern per section was basically this: I would go through every question on the review software for a section once, then I would go through them again (at least every other question). Monday through Fridays, I would try to study about 1-2 hours a night. On Saturdays, I would try to study about 3-5 hours. For FAR, I took probably about 4-5 months of focused studying. For REG I studied about three months. For Auditing, I only took about a month and a half. For Reg, I took about 2 months.

For the review software, each section had the following number of review questions.

AUD 830

BEC 1046

FAR 1749

REG 1339

Total 4964

Assuming conservatively that I went through every question once my first time through and every other question my second time through (often I did more), I reviewed questions 7,446 times. Very, very time consuming. Not saying everyone needs to study that much. This was simply my approach.

But it all paid off. My scores for the sections ended up being (note: 75 needed to pass)....

FAR 91

REG 82

AUD 89

BEC 92

Passing any one of the sections is a big accomplishment. If you don't believe me, below are the pass rates for each section for 2012.

UNIFORM CPA EXAMINATION PASSING RATES

2012

Section

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

Cumulative

|

AUD

|

44.90%

|

47.81%

|

50.08%

|

44.15%

|

46.89%

|

BEC

|

48.63%

|

53.17%

|

57.63%

|

50.57%

|

52.83%

|

FAR

|

43.84%

|

46.49%

|

53.91%

|

45.53%

|

47.97%

|

REG

|

45.00%

|

49.62%

|

51.26%

|

46.02%

|

48.15%

|

So yeah, passing any given section is an accomplishment. Passing all four on your first try is an even bigger deal. Upon a quick search, I found statistics from anywhere to 3-30% of test takers accomplish this. The actual number is probably in the middle somewhere, probably around 20%. Not trying to brag (ok, maybe just a little). I'm just still really excited to be done.

That's it for now.

Huge, huge accomplishment. Very nicely done!

ReplyDeleteNice one, Joshua! I hope it’s not too late to congratulate you. How’s it been since you passed? I have to say, being part of the 3 - 30% truly is an achievement! And you sir, passed with flying colors! I guess you can say that the money you put into the CPA exam was money well invested, yes? You can brag all you want. You deserve it. Congratulations, sir!

ReplyDeleteElias Brasel @ OnCoreBookKeeping Services